First off, why do we care so much about Japan and the BOJ? It’s because they’re by far the largest holder of US debt and equities, holding over 1.1 Trillion US dollars worth of debt.

Japan’s incredible foreign holdings of US debt is widely regarded as the spread trade. The spread trade involves Japanese investors selling their Yen in favor of USD to take advantage of the rate spread. US bonds currently offer far higher rates than Japan.

If the spread trade were to unwind, Japanese holders of US debt would sell their US debt and move back to the Yen, creating a massive outflow from US debt and equities, adding heavy pressure to both markets.

If the spread trade collapsed. Spread trade holders would be selling their USD in favor of Yen. This would force more spread traders in the red, causing more currency exchange, and so on. The same would be true for US stocks and bonds, as Japanese holders rush to sell both.

What would cause the spread trade to collapse? A continuous increase in the Japanese Yen, or an increase in Japanese yields could induce a spread trade collapse. We are currently seeing the latter, but only to a small extent.

If the BOJ were to pivot, a spread trade collapse would be near certain. However, they’ve maintained a dovish policy for 3 decades; why would they pivot now? The answer: Inflation is on multi-decade highs, and they may be forced to.

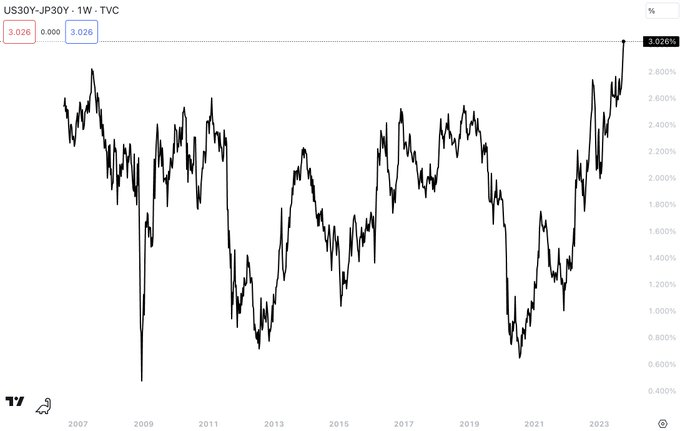

The Japanese yield curve is the steepest it has ever been. The long end of the Japanese curve indicates higher rates, and the BOJ, like the fed, may be forced by inflation to listen to the bond market and pivot.

If the BOJ pivots, the spread between US and Japanese yields may tighten, creating lower demand for US bonds from Japanese investors, thus placing pressure on the spread trade.

There are many factors pointing to a Japanese spread trade change and a BOJ pivot. If either were to happen, there could be a mad rush from the dollar to the yen in a race out of US bond and equity markets from foreign holders.