Currency management has (mostly) fallen out of the headlines. But there is still a lot of management going on!

Of course, the Chinese yuan still attracts the most sustained attention. With the dollar’s recent rebound and the run of relatively bad Chinese data, it is once again getting close to the weak edge of the trading band set by the central parity.

7.2 (fix) and 7.3 and change also set the weak edge of the band in which the CNY has been allowed to move after the global financial crisis, so there is (rightly) particular interest in how China manages its currency at these levels.

Zooming in to focus on the last 12ms or so makes two things clear — China “fixed” the fix to stop the yuan’s depreciation, and the yuan was at the weak edge of its trading band during from mid August to mid November (and may return there soon)

The interesting thing? PBOC’s balance sheet reserves didn’t fall during this period and they have shot up in the last few months. FX settlement (which includes the state banks) does show sales from August on, but the stability of the PBOC’s balance sheet is striking!

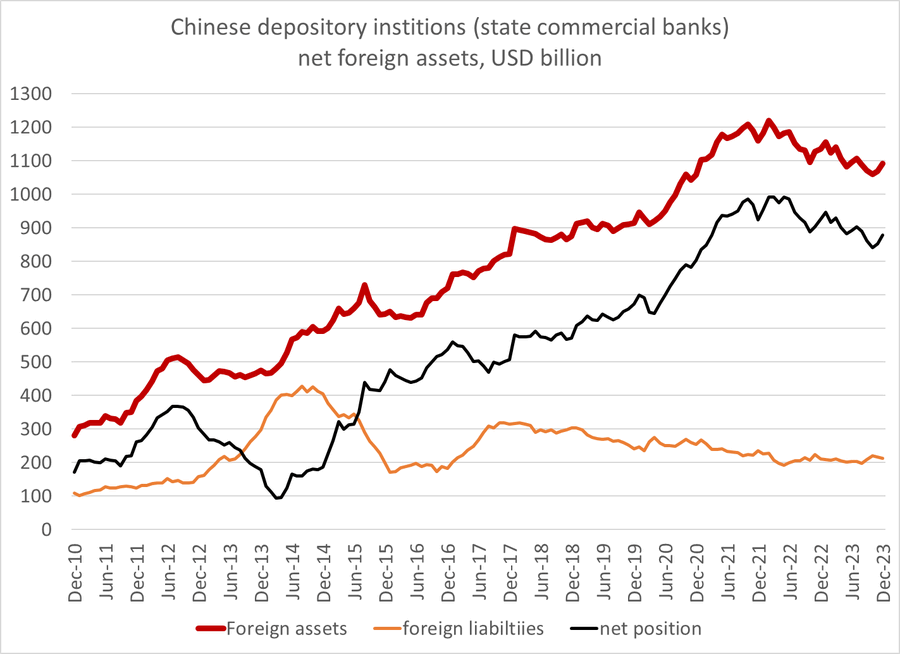

It thus isn’t clear if the PBOC actually sold fx to defend the band — or for that matter, just how much fx the state banks sold. The banking data shows sales in q3, but purchases (a rise in their net foreign assets) in q4.

So, in broad terms, it is clear that China managed its currency — but it isn’t totally clear precisely how China managed its currency. One would expect the central bank to sell reserves to defend the weak edge of a band, but there isn’t formal evidence that this happened.

Reuters thinks that China was able to talk the state banks into supporting the yuan , which makes sense — but it isn’t a textbook form of intervention (nor is it the kind of intervention the Treasury or the IMF really can track) – https://t.co/YiNQWl4CmB

and conceptually the stability of the yuan in the first half of q4 at least is a bit hard to square with the rise in the foreign assets of the state banks and the concurrent rise in the PBOCs reserves in q4.

We, at least think understanding the mechanics of China’s activity in the market is important — and would be relieved to learn that either the Treasury or the IMF has cracked China’s code.

Settlement generally did show sales in the second half of the year, which would make sense (only it doesn’t line up with the q3 BoP reserves or the q4 state banking data.

References: Mr. Brad, Bloomberg, Reuters, Twitter