[responsivevoice_button rate=”1.5″ pitch=”1.2″ volume=”1.2″ voice=”US English Female” buttontext=”Play!”]

The dollar is quite strong, especially v Asian currencies. The yen is insanely weak; the yuan is 7% below its level during the “repeg” of 08/09 (and that was considered an undervalued yuan) … So it is reasonable to ask how the dollar is impacting import prices!

The answer is “not very much” — which both a surprise and not a surprise. Import prices are much higher than they should be based on the dollar’s level (the surprise); but the dollar hasn’t impacted trade flows in the expected way since 2021 (so not a total surprise)

Note that I switched to a 2-axis graph, with the dollar on a scale 3x that of import prices (so the lines match with an import price elasticity of 0.33). Every fit perfect through 2016 … and it basically all fit reasonably til end 2020 … but not since.

Let’s focus for a moment on the price of imported autos and consumer goods. So far dollar strength hasn’t had any impact on either set. that’s strange (pandemic series break is real …) 4/

Take auto import prices – and the price of imports from Japan (which are heavily autos … ) They typically do respond to the dollar: see 2012 to 2016. But auto import prices have continued to climb even as the dollar strengthened. & no JPY impact either 5/

I think we know the reason for this — we have noted that US (and it is true globally too) auto production was very slow to recover from the pandemic. & some big producers (BMW and Mercedes for ex) discovered that they made more money by producing less!

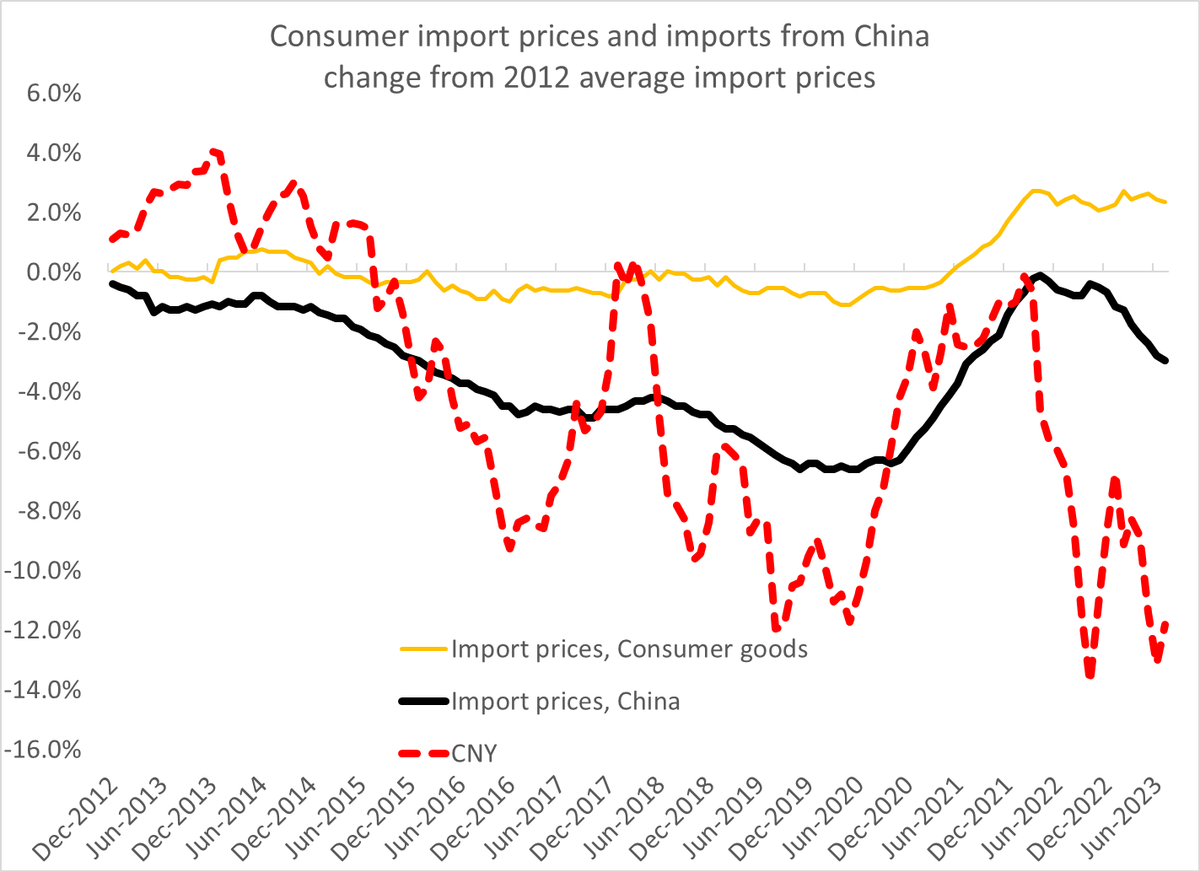

Now consider the data for China (together with consumer good import prices, which also include patent protected pharma). The price of imports from China historically has tended to fall absent CNY appreciation, and to fall faster when the CNY depreciates.

As you can see from the preceding chart, import prices from China (these are pre tariff) are starting to fall — but the price level remains well above its late 19/ early 20 level (back when the CNY was comparably weak)

In my last chart I smoothed out the volatility by taking a trailing 12m average of currency values and import prices (and did the % change v the average levels of 2012). Think it speaks for itself.

At some point I do expect dollar strength to start to lead to increasing import volumes (so far the unwinding of pandemic supply chain bullwhip effects has dominated) and to put downward pressure on import prices. but so far that is the dog that hasn’t barked.